The Marquee Loop: Cash Out refinancing

Cash-out refinancing is a financial option available to homeowners who want to tap into the equity they have built in their home. It involves…

The Marquee Loop: Private Mortgage insurance

Private Mortgage Insurance (PMI) is a type of insurance that protects lenders in case a borrower defaults on their mortgage loan. PMI is typically…

The Marquee Loop, Mortgage Myths

Mortgage Myths: You should always choose a mortgage based on the lowest monthly payment mortgage myth. Yes, the statement “You should always choose a…

The Marquee Loop: Conventional Loans

Conventional loans are mortgage loans that are not insured or guaranteed by a government entity. Instead, they are offered by private lenders such as…

The Marquee Loop: Discount points

Discount points are a type of prepaid interest that a borrower can pay upfront to lower the interest rate on their mortgage. Each discount…

The Marquee Loop: 3 2 1 buydowns

3/2/1 buydowns are a type of mortgage financing option in which the borrower pays an upfront fee to lower their interest rate and mortgage…

The Marquee Loop: Reverse Mortgages

A reverse mortgage is a type of loan that allows homeowners who are 62 years or older to convert a portion of their home…

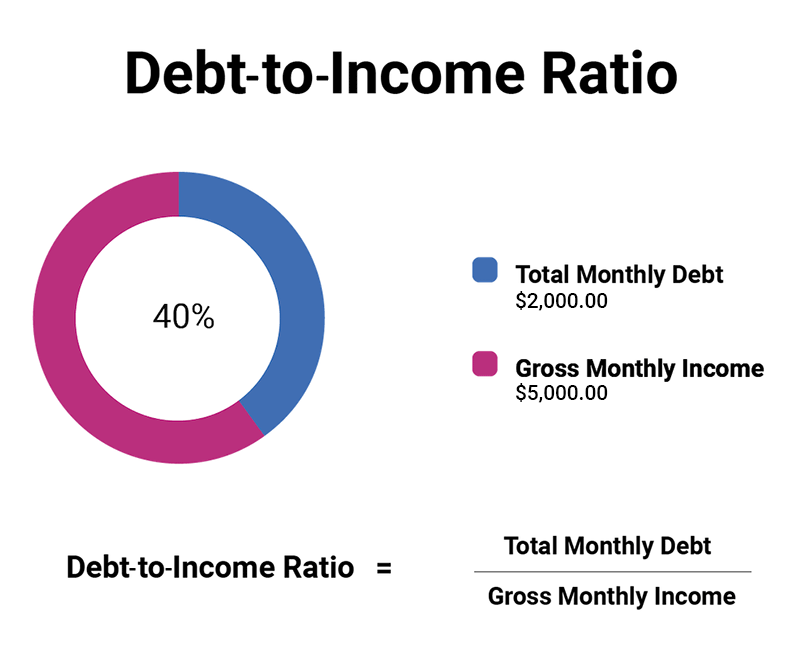

The Marquee Loop: Debt-to-Income Ratio

Debt-to-income ratio (DTI) is a financial measure used by lenders to evaluate a borrower’s ability to manage monthly payments and repay their debts. It…

The Marquee Loop: The Loan Process

The loan process simplified: Most borrowers today are under the impression that the loan process is time consuming, tedious, invasive, and that certain documentation…

Marquee Madness: First time homebuyer tips

Looking to purchase your very first home? Please continue reading and you’ll find some basic mortgage tips to help first time buyers qualify Being…

Arizona Mortgage Broker #0909566 NMLS #144884

Marquee Mortgage, LLC

www.marqueemortgagellc.com

Loan Originators:

- Keith Nelson NMLS #145678

- Rick Giordano NMLS #160921

- Randy Osterman NMLS #145673

- Justin Jean NMLS #2012654