The Marquee Loop: Debt-to-Income Ratio

Debt-to-income ratio (DTI) is a financial measure used by lenders to evaluate a borrower’s ability to manage monthly payments and repay their debts. It is calculated by dividing the borrower’s total monthly debt payments by their gross monthly income.

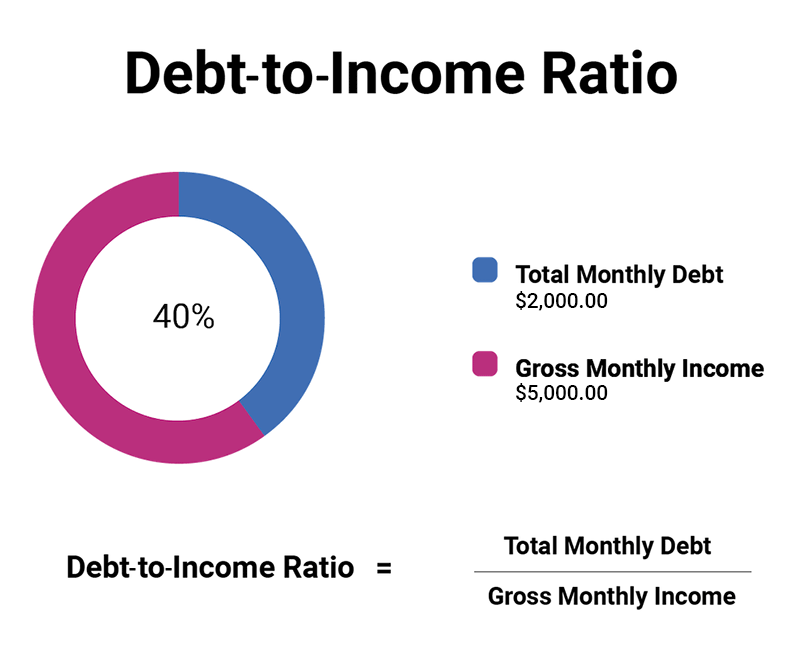

For example, if a borrower has a total monthly debt payments of $2,000 and a gross monthly income of $5,000, their DTI ratio would be 40% ($2,000 / $5,000).

Lenders use DTI ratios to assess the borrower’s financial situation and determine whether they are a good candidate for a loan or credit. A high DTI ratio indicates that the borrower has a lot of debt relative to their income, which could make it difficult for them to make their monthly payments on time.

Lenders generally prefer borrowers with lower DTI ratios, as it indicates that they have more disposable income available to make their loan payments. A DTI ratio of 36% or less is generally considered good, while a DTI ratio of 43% or higher may make it harder for the borrower to qualify for certain types of loans. However, the acceptable DTI ratio can vary depending on the lender, the type of loan, and other factors.