The Marquee Loop: 3 2 1 buydowns

3/2/1 buydowns are a type of mortgage financing option in which the borrower pays an upfront fee to lower their interest rate and mortgage…

The Marquee Loop: Reverse Mortgages

A reverse mortgage is a type of loan that allows homeowners who are 62 years or older to convert a portion of their home…

The Marquee Loop: Freddie Mac/Fannie Mae

Fannie Mae and Freddie Mac are two government-sponsored enterprises (GSEs) that were established to provide liquidity and stability to the secondary mortgage market. The…

The Marquee Loop: HELOCs

A Home Equity Line of Credit (HELOC) is a type of loan that allows you to borrow money against the equity in your home.…

The Marquee Loop, Mortgage Myths: Only income determines how much you can borrow

Myth: Only income determines how much you can borrow This is a common myth about mortgages, but it is not entirely true. While your…

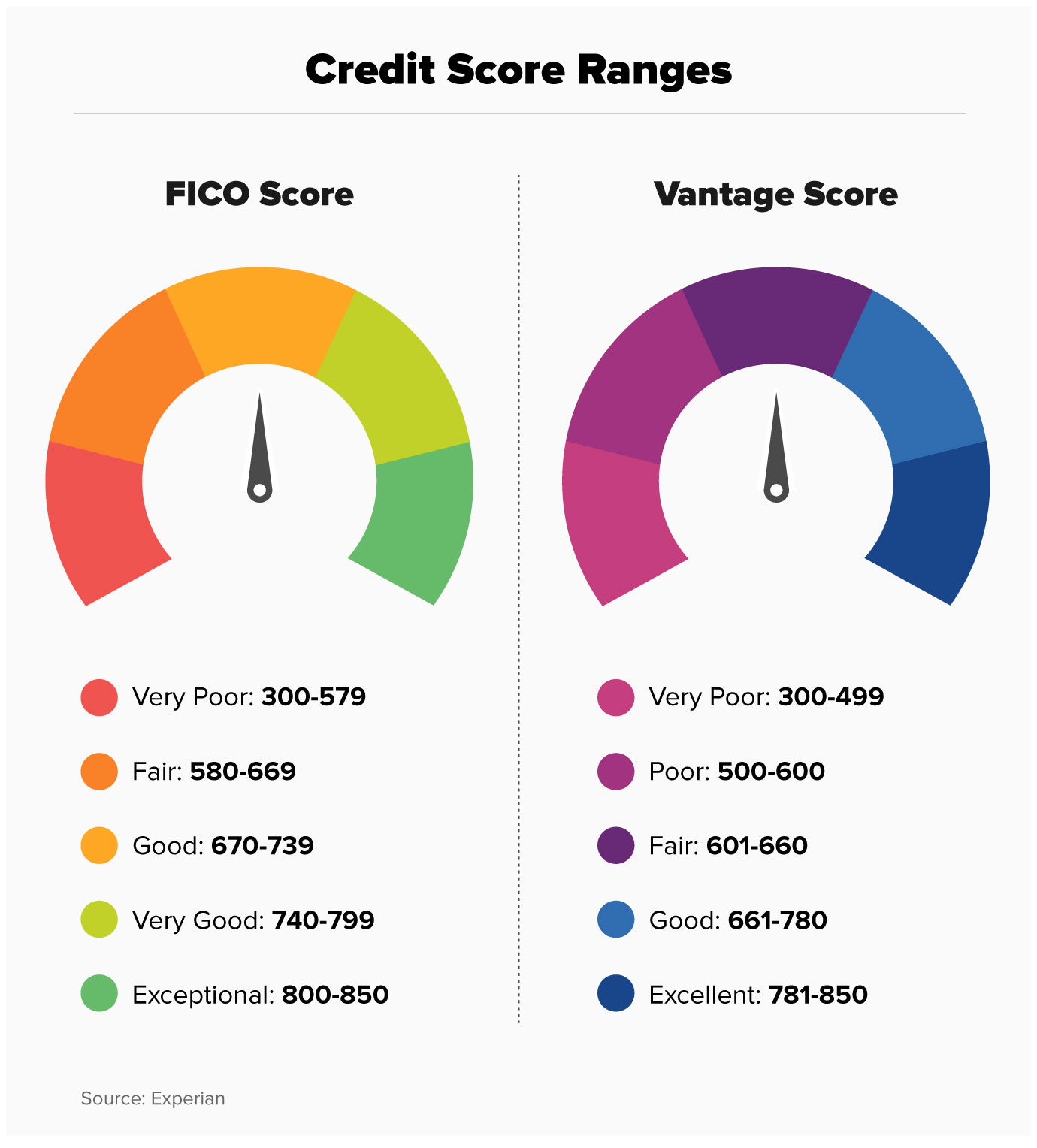

The Marquee Loop: Credit Scores

Credit scores are numerical ratings that reflect a person’s creditworthiness and their ability to repay loans on time. The most commonly used credit score…

The Marquee Loop: Closing Costs

Closing costs are fees and expenses associated with the finalization of a real estate transaction, typically when purchasing or refinancing a home. These costs…

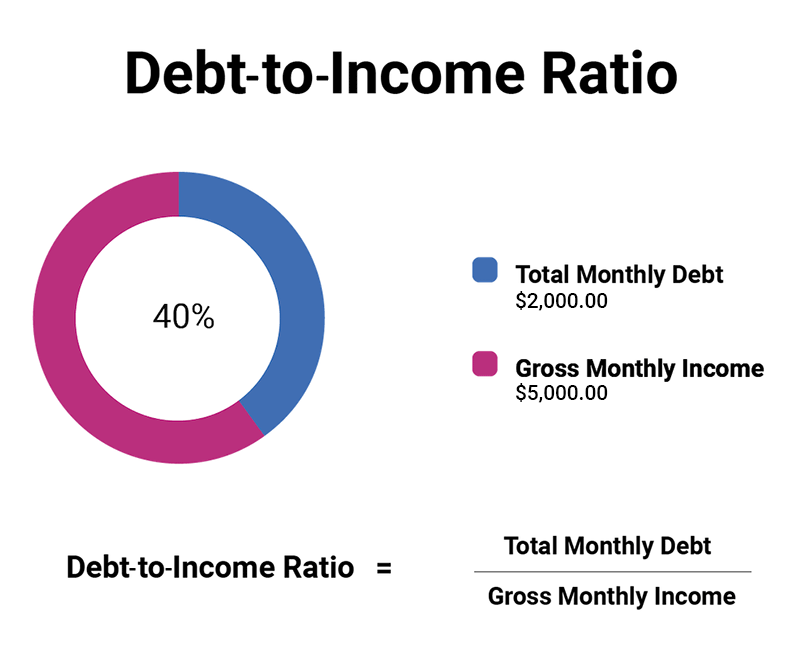

The Marquee Loop: Debt-to-Income Ratio

Debt-to-income ratio (DTI) is a financial measure used by lenders to evaluate a borrower’s ability to manage monthly payments and repay their debts. It…

The Marquee Loop: Mortgage Myths; Bankruptcies part 2

Welcome back to the Marquee Loop. We are diving back into Mortgage Myths, specifically myths surrounding mortgages and bankruptcy. Here are a few more…

The Marquee Loop: Having an HOA (The Pros & Cons)

The option of moving into a property with an HOA or not, is a personal choice for future homeowners. Moving into a home with…

Arizona Mortgage Broker #0909566 NMLS #144884

Marquee Mortgage, LLC

www.marqueemortgagellc.com

Loan Originators:

- Keith Nelson NMLS #145678

- Rick Giordano NMLS #160921

- Randy Osterman NMLS #145673

- Justin Jean NMLS #2012654