Understanding the Impact of Credit Scores on Your Mortgage Rate

When it comes to securing a mortgage, one of the most critical factors lenders consider is your credit score. This three-digit number can significantly influence not only your eligibility for a loan but also the interest rate you’ll be offered. In this blog, we’ll explore how credit scores impact mortgage rates and share tips on improving your score before you apply.

How Credit Scores Affect Mortgage Rates

1. The Basics of Credit Scores

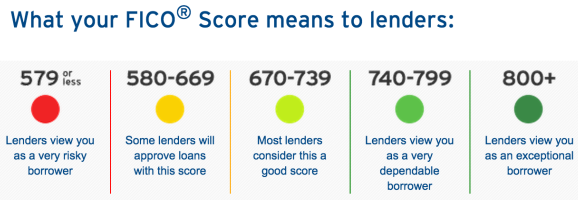

Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. Lenders use these scores to assess the risk of lending you money. Generally, a score of 740 or above is considered excellent, while scores below 620 may limit your mortgage options.

2. Risk Assessment

Lenders view credit scores as a predictive measure of your likelihood to repay the loan. A higher score suggests that you have a history of responsible credit management, while a lower score may raise red flags about your financial behavior. As a result, borrowers with higher credit scores often qualify for lower mortgage rates, which can lead to significant savings over the life of the loan.

3. Rate Differences

The difference in mortgage rates based on credit scores can be substantial. For example, a borrower with a score of 760 could receive a rate that is 0.5% lower than someone with a score of 620. Over a 30-year mortgage, this seemingly small percentage can translate to tens of thousands of dollars in extra interest payments.

Tips for Improving Your Credit Score

If you’re planning to apply for a mortgage, it’s wise to focus on boosting your credit score. Here are some practical tips to help you improve your score before your application:

1. Check Your Credit Report

Start by obtaining a free copy of your credit report from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Review them for any errors or discrepancies, such as incorrect account information or late payments. Disputing these inaccuracies can help improve your score.

2. Pay Your Bills on Time

Your payment history accounts for a significant portion of your credit score. Setting up reminders or automatic payments can help ensure that you never miss a due date.

3. Reduce Your Credit Utilization

Aim to keep your credit utilization ratio (the amount of credit you’re using compared to your total credit limit) below 30%. Paying down existing credit card balances and avoiding new large purchases on credit can improve this ratio.

4. Avoid Opening New Accounts

Each time you apply for new credit, a hard inquiry is recorded, which can temporarily lower your score. Avoid applying for new credit cards or loans in the months leading up to your mortgage application.

5. Maintain Older Accounts

The length of your credit history also plays a role in your credit score. Keeping older credit accounts open, even if you don’t use them often, can positively impact your score.

6. Diversify Your Credit Mix

Having a mix of credit types—such as credit cards, installment loans, and mortgages—can help boost your score. However, be cautious; only take on new debt if you can manage it responsibly.

Understanding the impact of credit scores on your mortgage rate is essential for anyone looking to buy a home. By improving your credit score, you can position yourself for better loan options and lower interest rates. Whether you’re a first-time homebuyer or looking to refinance, taking these steps can make a significant difference in your financial future. Remember, it’s never too early to start working on your credit health, so begin today.