The Marquee Loop: Credit Scores

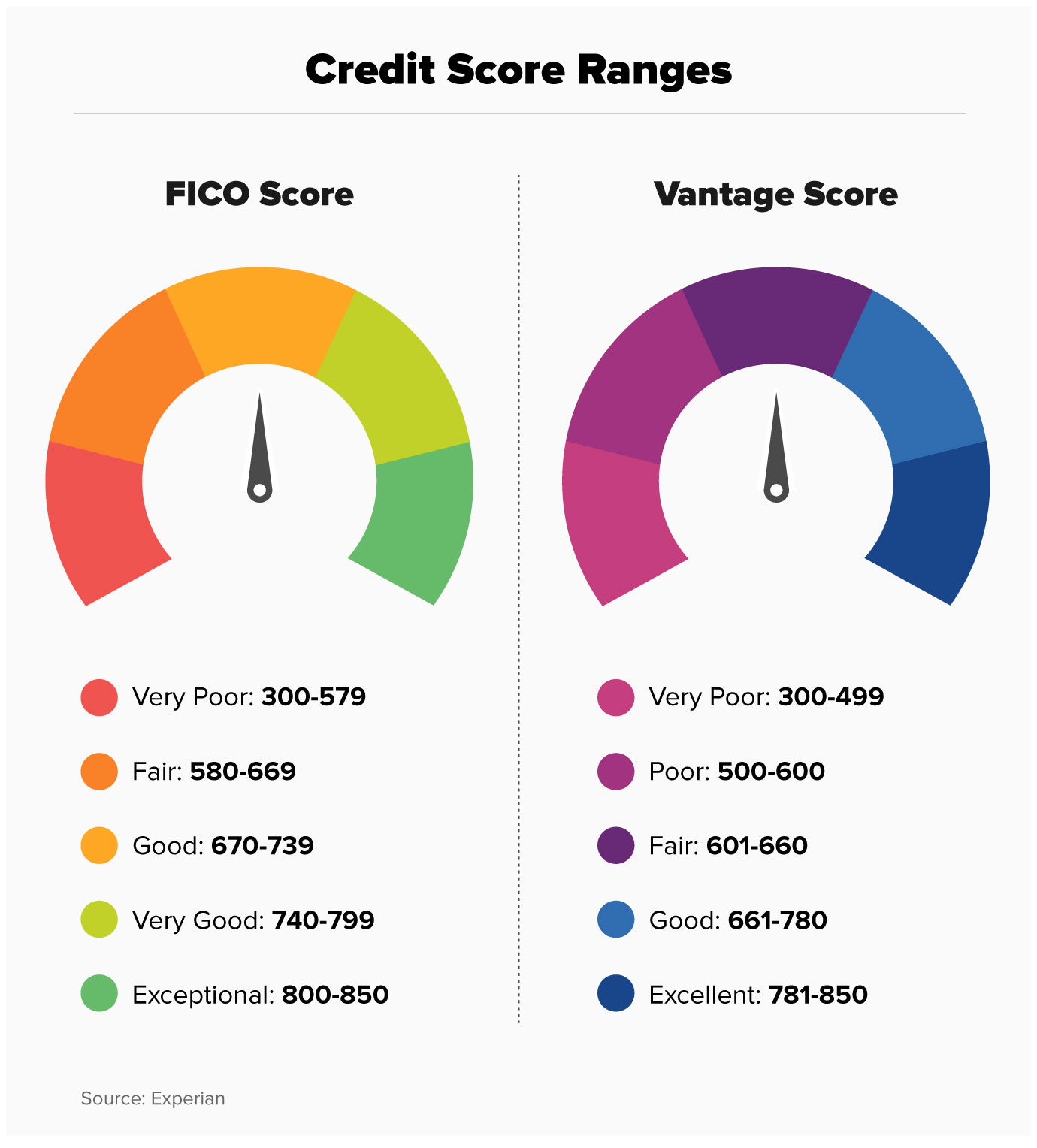

Credit scores are numerical ratings that reflect a person’s creditworthiness and their ability to repay loans on time. The most commonly used credit score model in the United States is the FICO score, which ranges from 300 to 850. The higher the score, the better the creditworthiness of the person.

Credit scores are calculated based on several factors, including:

- Payment history: This refers to whether a person has paid their bills on time or not. Late payments or missed payments can have a negative impact on credit scores.

- Credit utilization: This refers to the amount of credit a person is using compared to their total credit limit. High credit utilization can indicate financial stress and may lower a person’s credit score.

- Length of credit history: This refers to how long a person has been using credit. A longer credit history can indicate responsible credit management and may positively impact a person’s credit score.

- Types of credit: This refers to the different types of credit a person has, such as credit cards, loans, and mortgages. A diverse mix of credit may positively impact a person’s credit score.

It’s important to maintain a good credit score as it can affect your ability to obtain loans, credit cards, and other financial products. A higher credit score may also result in better interest rates and loan terms.

Credit score requirements can vary depending on the lender and the type of credit product you’re applying for. In general, lenders use credit scores to help determine a borrower’s creditworthiness and the likelihood that they will pay back their debts on time.

Here are some general guidelines for credit score requirements for common types of credit products:

- Credit cards: Most credit card users require a credit score of at least 670, although some may accept lower scores.

- Personal loans: Many lenders require a minimum credit score of 600 to qualify for a personal loan.

- Mortgages: The minimum credit score required to qualify for a mortgage can vary depending on the type of loan and the lender, but generally, a score of 620 or higher is required for conventional loans.

- Auto loans: A credit score of at least 660 is typically required to qualify for an auto loan, although some lenders may accept lower scores.

It’s important to remember that credit score requirements are just one factor that lenders consider when evaluating your creditworthiness. Other factors, such as your income, employment history, and debt-to-income ratio, also play a role in the decision-making process.