Marquee Madness: The Phx Housing Market 2023

New Year, New house?

Continue reading to get the latest insight on factors that could impact the Phoenix Housing Market in 2023.

Everyone knows that 2022 was a rough year for homebuyers. With higher rates and a limited housing inventory, most home buyers stopped shopping for their new home around the summer of 2022. At least one of these conditions appears to be changing for the better.

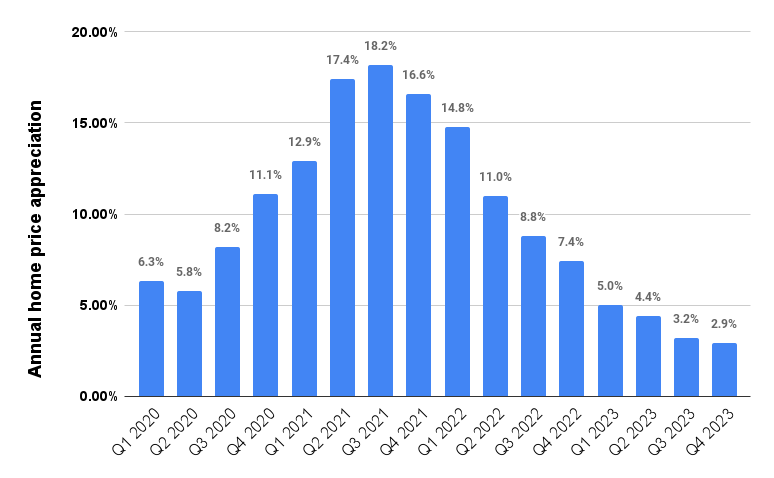

Mortgage rates started trending lower at the end of November 2022 and this is a positive sign for potential buyers and might be their que to start house hunting again. Home appreciation in the valley has also slowed dramatically since the pandemic peak at the end of 2021. The graph below shows what most experts are predicting for home appreciation by each quarter of 2023.

Rates Rates Rates!

With interest rates starting to decline, home buyers should see a significant savings in their monthly mortgage payment! For example; a mortgage loan amount of $400,000 that has a 30 year fixed rate at 7% would equate to a principal and interest payment of $2661 per month. For the same loan amount, at a rate of 6%, would reduce the principal and interest payment to $2398 per month. That 1% drop in rate would equal $263 per month in a lower mortgage payment.

In summary, early 2023 could be the right time for buyers to jump back into the market and purchase their new home.

*Marquee Mortgage LLC, is an independent, full service broker specializing in purchase money loans, refinances and creative lending solutions.