Marquee Madness: Credit Scores

Why credit scores affect more than just your borrowing costs

A credit score by definition, is a prediction of your credit behavior, such as how likely you are to pay a loan back on time, based on information from your credit reports. However, most people don’t know that your credit score also could affect premiums you pay on all types of insurance: (auto, life & private mortgage insurance), your ability to qualify for a job and whether you can obtain a lease of any kind, including an apartment.

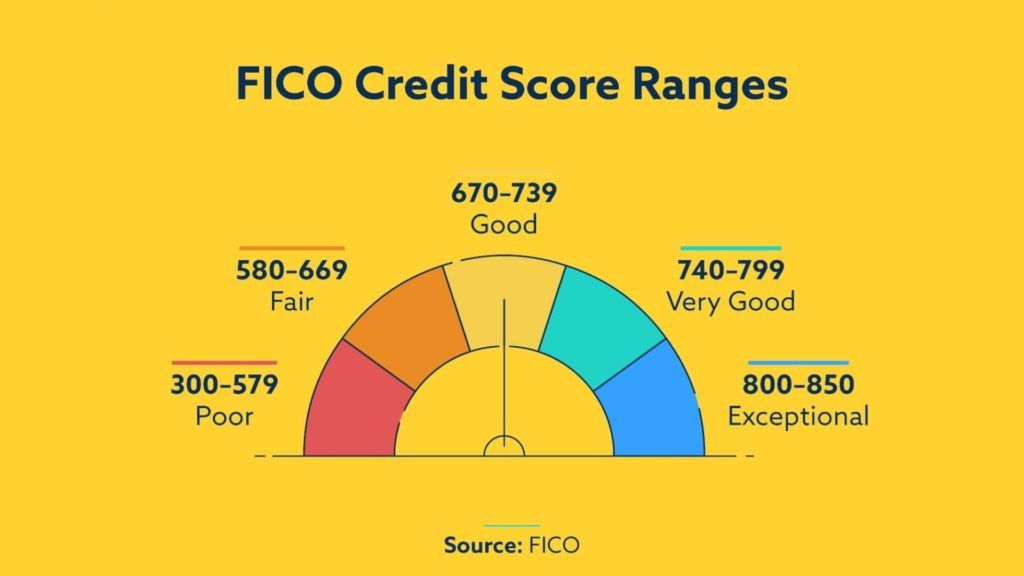

Everyone knows that the higher their credit score, the lower their borrowing cost. Here’s a quick example below to illustrate that point. Credit scores range from approximately 300 to 850. You want to borrow $200,000 in the form of a fixed rate thirty-year mortgage. If your credit score is in the highest category, 760-850, a lender might charge you 3.307 percent interest for the loan which means you would do monthly payment of $877. If, however, your credit score is in a lower range, 620-639 for example, lenders might charge you 4.869 percent that would result in a $1,061 monthly payment. Although quite respectable, the lower credit score would cost you $184 a month more for your mortgage.

Here are a list of good credit habits that can help improve your credit score

- Track your bill payment history

- Keep your credit utilization low, ideally under 30%

- Pay every bill on time

- Don’t close old credit accounts

- Don’t apply for too many accounts

At the end of the day, establishing and maintaining good credit is a gage of how reliable and responsible a person is. We are experts at teaching our clients simple ways to improve their credit scores, feel free to call for a no cost consultation.

*Marquee Mortgage LLC, is an independent, full service broker specializing in purchase money loans, refinances and creative lending solutions.

LET’S STAY IN TOUCH!