Navigating Mortgage Options as a First-Time Investor: A Comprehensive Guide

Investing in real estate can be an exciting and profitable venture, but for first-time investors, navigating the world of mortgages for rental or investment…

Mortgage Hacks for Self-Employed Borrowers: Tips to Boost Your Approval Chances

Mortgage Hacks for Self-Employed Borrowers: Tips to Boost Your Approval Chances Being self-employed has its perks—flexibility, control over your work, and the potential for…

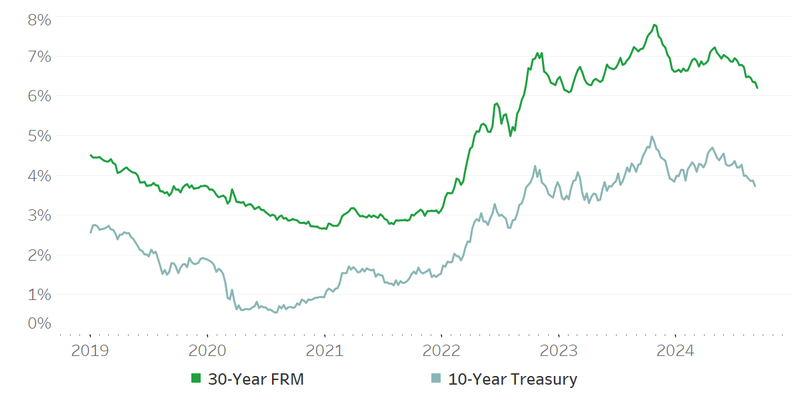

Breaking Down the Latest Changes in Mortgage Rates: What Borrowers Need to Know

Mortgage rates are a critical factor in the home buying and refinancing process, influencing monthly payments, total loan costs, and the overall affordability of…

The Pros and Cons of an All-Cash Offer vs. Financing in Today’s Market

In today’s competitive real estate market, buyers often face the pivotal decision of whether to make an all-cash offer or finance their home purchase…

Mortgage Assistance Programs in 2024: What’s New and How to Qualify

As the housing market evolves, so do the programs designed to help buyers and homeowners navigate the financial landscape. In 2024, new and updated…

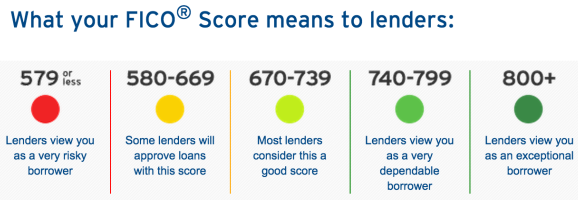

Understanding the Impact of Credit Scores on Your Mortgage Rate

When it comes to securing a mortgage, one of the most critical factors lenders consider is your credit score. This three-digit number can significantly…

How to Maximize Your Down Payment Assistance Programs

Buying a home can feel daunting, especially when it comes to gathering enough funds for a down payment. Fortunately, various down payment assistance programs…

Navigating the Current 2024 Housing Market: What Homebuyers Need to Know

The 2024 housing market has presented both challenges and opportunities for prospective homebuyers. With fluctuating interest rates, changing inventory levels, and economic factors at…

The Role of Technology in Mortgage Approval: What You Need to Know

Technology has revolutionized almost every aspect of our lives, and the mortgage industry is no exception. What used to be a tedious and paperwork-heavy…

Mortgage Myth vs. Fact: Paying Off Your Mortgage Early Always Saves You Money

Mortgage Myth vs. Fact: Paying Off Your Mortgage Early Always Saves You Money Myth: Paying Off Your Mortgage Early Always Saves You Money Paying…

Arizona Mortgage Broker #0909566 NMLS #144884

Marquee Mortgage, LLC

www.marqueemortgagellc.com

Loan Originators:

- Keith Nelson NMLS #145678

- Rick Giordano NMLS #160921

- Randy Osterman NMLS #145673

- Justin Jean NMLS #2012654