Breaking Down the Latest Changes in Mortgage Rates: What Borrowers Need to Know

Mortgage rates are a critical factor in the home buying and refinancing process, influencing monthly payments, total loan costs, and the overall affordability of real estate. In recent times, we’ve seen some significant fluctuations in mortgage rates, which can be attributed to a variety of economic factors, including central bank policies, inflation rates, and broader economic conditions. Here’s what potential homebuyers and those looking to refinance need to understand about the current trends in mortgage rates and their impact.

Recent Trends in Mortgage Rates

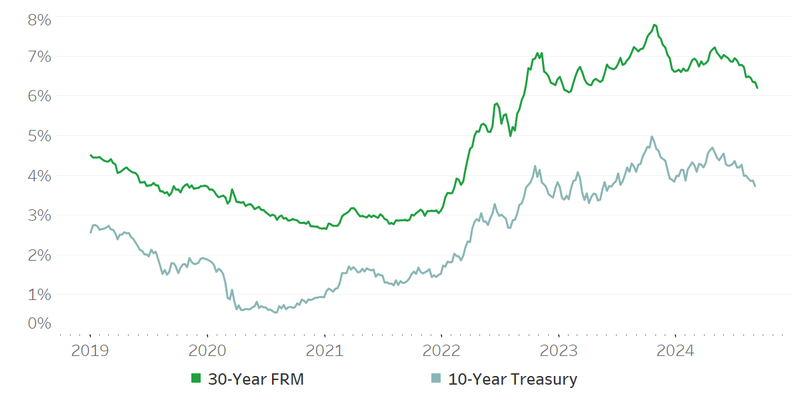

Mortgage rates have been on a rollercoaster over the past few months, primarily influenced by the Federal Reserve’s actions to combat inflation. In an attempt to temper inflationary pressures, the Fed has adjusted interest rates, directly impacting mortgage rates. Recently, we’ve seen these rates climb, reaching levels not seen in several years. This increase is a reaction to not just domestic fiscal policies but also global economic uncertainties, such as fluctuating energy prices and supply chain disruptions.

For borrowers, this means that the cost of borrowing money to purchase a home is higher than it was at the start of the year. However, these rates are still historically low compared to the highs seen in previous decades.

Impact on Homebuyers

For potential homebuyers, the increase in mortgage rates can have mixed implications. On one hand, higher rates mean higher monthly payments and more money paid in interest over the life of the loan. This can reduce buying power, as the same monthly budget now affords less in terms of home prices.

However, there’s also a silver lining. Rising rates can cool down overheated housing markets. As borrowing costs increase, some buyers may decide to wait on the sidelines, leading to a decrease in competition and potentially slowing the rapid price escalation we’ve seen in many markets. For those who can afford to buy, this might mean more negotiating power and more options to choose from.

Impact on Refinancers

For those looking to refinance, the impact of rising rates is more straightforward: higher rates generally make refinancing less attractive. Homeowners who secured low rates in recent years are unlikely to find financial benefit in refinancing at the current higher rates. However, for those with adjustable-rate mortgages or high-interest loans, refinancing could still be a beneficial move, especially if it’s done to secure a fixed-rate mortgage before rates climb further.

Overall Market Impact

The rise in mortgage rates affects more than just individual homebuyers and homeowners. It influences the entire housing market and, by extension, the broader economy. Higher rates tend to slow down the pace of home sales and can lead to a cooling of home prices, which impacts home equity and consumer spending. For the housing industry, this can mean a shift from a seller’s market to a more balanced or even a buyer’s market, depending on how significant the rate changes are.

Looking Ahead

Predicting the future path of mortgage rates is always challenging, as they are influenced by a wide range of economic and geopolitical factors. However, potential borrowers should stay informed about economic forecasts, Fed announcements, and trends in the global economy—all of which can provide clues about where rates might head next.

Staying informed and working closely with mortgage professionals can help borrowers navigate this complex landscape. Whether you’re looking to buy a new home or considering refinancing, understanding the dynamics of mortgage rates is crucial in making informed financial decisions. As always, it’s advisable to consult with a financial advisor to tailor strategies that best fit your personal financial situation and goals.